Amid a notable deceleration in consumer demand, analysts argue that luxury watches and jewelry remain steadfast as valuable investments during times of economic uncertainty. This sentiment was echoed amidst the opulence of the LVMH Watch Fair held in Miami this past January, an event that annually congregates executives from the pinnacle of luxury goods companies.

Despite the event’s glamorous setting, it underscored a growing unease within a sector that has traditionally weathered economic storms with resilience. This unease stems from a wider deceleration in luxury goods spending coupled with the inflationary pressures of the pandemic, which have notably inflated resale prices to unprecedented levels.

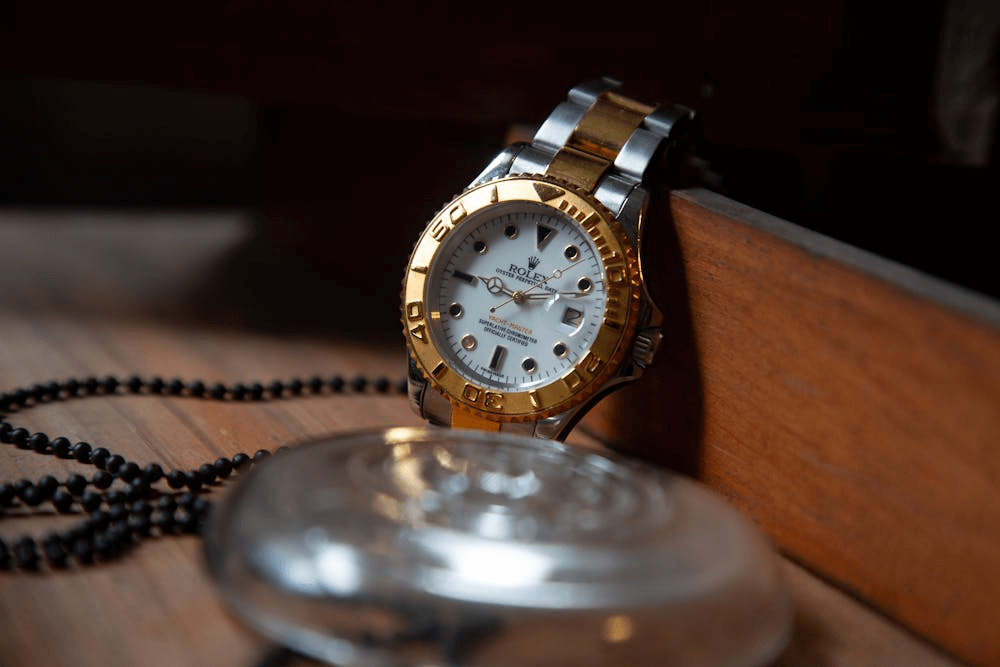

Watches of Switzerland, the United Kingdom’s premier retailer of prestigious timepieces such as Rolex, Breitling, and Cartier, encountered a harsh reality in January when it had to issue a significant profit warning. The company acknowledged its underestimation of the downturn in luxury goods spending, a revelation that precipitated a steep decline in its share price.

Shortly after that, Swatch Group, the Swiss conglomerate behind the Omega and Swatch brands, disclosed its failure to meet annual profit expectations. The group observed a shift in consumer preferences towards more affordable products, particularly in mainland China, indicating a broader trend of cautious spending within the luxury sector.

Navigating the Luxury Watch Market Landscape

Arien van de Waal, CEO of Watchfinder, a UK-based enterprise specializing in acquiring and selling pre-owned luxury watches and a subsidiary of Richemont, remarked on the pandemic-induced surge in demand for high-end watches as an anomaly that has since begun to wane.

The luxury watch market is a complex ecosystem comprising retailers like Watches of Switzerland and Bucherer (recently acquired by Rolex) and design powerhouses such as Richemont and LVMH, which produce and market their brands.

This sector is epitomized by the revered “holy trinity” of Swiss watchmakers Audemars Piguet, Patek Philippe, and Richemont’s Vacheron Constantin, known for their distribution through third-party retailers and proprietary boutiques.

The Rise and Fall of Luxury Watch Demand

Throughout the pandemic, an influx of affluent buyers outpaced the production capabilities of Swiss watchmakers, spurring a burgeoning demand for pre-owned timepieces and elevating their prices to new zeniths. This period marked a lucrative phase for retailers and manufacturers within the industry.

Over the decade spanning 2013 to 2022, luxury watches surged past other collectible categories, including jewelry, handbags, wine, art, and furniture, in terms of growth. According to data from Boston Consulting Group, the watch sector saw an average annual growth of about 7% during this period, with a remarkable spike of 27% between 2020 and 2022.

Iconic models, such as the Patek Philippe Nautilus 5711/1A, saw their value skyrocket in the resale market during the pandemic, a trend highlighted by John Reardon, former international head of watches at Christie’s and founder of Collectability. Originally priced at under $40,000, these watches commanded prices exceeding $150,000 on the secondary market at the height of the pandemic.

Luxury Watch Sector in Transition

However, the subsequent quarters have witnessed a continuous decline in resale prices, with Morgan Stanley and WatchCharts data indicating a downturn for seven consecutive quarters following their peak in May 2022.

The average value of pre-owned watches from brands like Rolex, Patek Philippe, and Audemars Piguet, which had surged nearly 50% between early 2020 and 2022, saw a dramatic reduction of over 20% by the last quarter of the previous year, as per Matthew Clarke of The Real Real.

This downturn is symptomatic of a broader cooling in demand for new and pre-owned luxury watches, which has led to market polarization. Nicolas Lynas of BCG highlighted this shift, noting a divergence in client behavior.

Citi analysts have pointed out that the luxury watch sector is now navigating tumultuous waters, characterized by erratic demand patterns, structural challenges, and an increasing brand divide. A report by the bank underlined the contrasting fortunes within the sector, with Richemont’s jewelry sales climbing by 12% in the final quarter of 2023, in stark contrast to a modest 3% increase in watch sales.

Even Rolex, a dominant force in the market, has not been immune to these changing dynamics, as evidenced by the stagnation in average price increases for select models in the U.S., a crucial market. This stagnation marks a departure from the consistent price growth observed since 2015.

Adapting to Changing Market Dynamics

Furthermore, the disparity between the prices of new and used Rolex models has significantly narrowed, transitioning from a 90% resale premium in March 2022 to approximately 20% today, as reported by Morgan Stanley.

In response to these shifts, luxury watchmakers, including Rolex, appear to adopt a more cautious production strategy. Watches of Switzerland, a significant revenue source for Rolex, reported in January that it received more steel watches than the lavish steel and gold models, affecting its average selling prices.

Assessing the Luxury Watch Market Trends

As the luxury watch market evolves, many industry experts are pondering whether the era of the luxury watch boom is coming to an end. Factors such as shifts in consumer preferences, the rise of smartwatches, and economic fluctuations have sparked debates about the future trajectory of the luxury watch industry. According to a report by McKinsey, global luxury watch sales fell by 25% in 2020, reflecting the impact of the COVID-19 pandemic on consumer spending habits. While some argue that traditional luxury watches will always hold a special place in the hearts of collectors and aficionados, others point to emerging trends favoring digital alternatives and minimalist styles.

Amidst these discussions, luxury watch brands reevaluate their strategies to stay relevant in a rapidly changing landscape. Some embrace innovation by incorporating smart features into their timepieces, while others are doubling down on heritage and craftsmanship to appeal to traditionalists. The outcome of this dynamic interplay between tradition and innovation will shape the future of the luxury watch market and determine whether the industry can sustain its historical allure in the face of modern challenges.

This strategic adjustment reflects a broader industry trend towards prudence amid uncertain economic times, underscoring the luxury watch market’s ongoing struggle to navigate a period of recalibration and reevaluation. So, I hope you’ve got the answer to your question—Is the time of the luxury watch boom over?